All Categories

Featured

Take Into Consideration Utilizing the DIME formula: dollar stands for Debt, Earnings, Home Loan, and Education and learning. Total your debts, mortgage, and university expenses, plus your wage for the variety of years your family members needs security (e.g., until the youngsters run out your house), and that's your protection requirement. Some economic specialists compute the amount you need utilizing the Human Life Value approach, which is your life time income possible what you're earning now, and what you anticipate to earn in the future.

One way to do that is to look for business with strong Economic strength rankings. best term life insurance for diabetics. 8A firm that finances its very own policies: Some firms can offer policies from an additional insurance firm, and this can add an added layer if you intend to transform your policy or in the future when your household requires a payment

Nevada Term Life Insurance

Some companies use this on a year-to-year basis and while you can expect your rates to increase significantly, it may be worth it for your survivors. One more way to compare insurance coverage business is by considering on the internet consumer evaluations. While these aren't likely to tell you a lot about a company's monetary security, it can inform you just how easy they are to function with, and whether claims servicing is a problem.

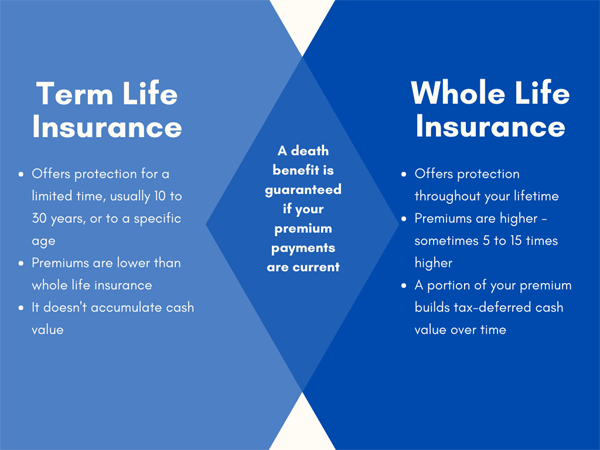

When you're more youthful, term life insurance can be a straightforward way to secure your loved ones. But as life changes your financial concerns can as well, so you may desire to have entire life insurance policy for its life time coverage and additional advantages that you can utilize while you're living. That's where a term conversion is available in - ad&d insurance vs term life insurance.

Approval is guaranteed despite your health and wellness. The costs will not enhance when they're set, however they will increase with age, so it's a great concept to secure them in early. Learn even more about how a term conversion functions.

1Term life insurance policy uses temporary security for an essential duration of time and is usually more economical than long-term life insurance coverage. what does level term life insurance mean. 2Term conversion guidelines and restrictions, such as timing, might apply; as an example, there might be a ten-year conversion benefit for some products and a five-year conversion privilege for others

3Rider Insured's Paid-Up Insurance coverage Acquisition Choice in New York. 4Not offered in every state. There is a cost to exercise this motorcyclist. Products and motorcyclists are offered in accepted territories and names and attributes may differ. 5Dividends are not ensured. Not all taking part policy owners are eligible for returns. For select cyclists, the problem applies to the guaranteed.

Latest Posts

When Does A Term Life Insurance Policy Matures

$25,000 Term Life Insurance Policy

Decreasing Term Life Insurance Quotes